PMEGP – Prime Minister Employment Generation Programme (PMEGP). The scheme has been started by the Central Government to provide employment opportunities to the unemployed youth in the country.

Table of Contents

In this scheme, a loan of Rs 20 lakh to 50 lakh is available for doing business. If you take loan under PMEGP scheme, you get subsidy up to 35%. That is, for example, if you have a loan of Rs 10 lakh, then Rs 3.5 lakh is waived off as subsidy. Prime Minister Employment Generation Programme (PMEGP)

Also Check – PM Vishwakarma Yojana Scheme 2024 Empowering Traditional Craftsmen and Artisans

In this article, we will see in detail about PMEGP SCHEME and one by one we will talk about all the topics related to this scheme such as:-

What is PMEGP scheme? Prime Minister Employment Generation Programme (PMEGP)

For which businesses, loans are available under this scheme?

How to apply for loan under PMEGP scheme?

What documents are required to take a loan?

How to apply online for PMEGP scheme?

That is, this will be a complete article about PMEGP scheme, if you are looking for a loan then you must read this article completely. So let’s start ONE BY ONE topic wise :-

What is PMEGP scheme? Does this scheme work all over India?

PMEGP Scheme (Prime Minister Employment Generation Programme) Prime Minister Employment Generation Program Loan Scheme, this is a loan scheme.

The main objective of this scheme is to create new jobs in the country. The government wants to provide employment opportunities to the unemployed citizens of the country. In this scheme, all unemployed people are given loans to start their own business.

This scheme runs all over India, people from all the states in the country can apply for this scheme. No matter which state you are a resident of, you can get a loan by applying under this scheme.

Eligibility Criteria For PMEGP scheme

- Any individual over the age of 18;

- There will be no income limit for assistance in establishing projects under the PMEGP.

- Beneficiaries must have at least an VIII standard pass educational qualification to set up projects costing more than Rs.10 lakh in the manufacturing sector and more than Rs.5 lakh in the service/business sector.

- Scheme assistance is only available for new viable projects sanctioned specifically under the PMEGP.

- Existing units and units that have previously received Government Subsidies (under PMRY, REGP, PMEGP, CMEGP, or any other scheme of the Government of India or a State Government) are ineligible.

- Projects with no capital outlay (Term Loan) are ineligible.

- The cost of land cannot be included in the project budget.

- All Implementing Agencies (KVIC, KVIB, DIC, and Coir Board) have the ability to process applications in both rural and urban areas.

- The applicant must have a valid Aadhaar Number.

Online Application Procedures for PMEGP Scheme

- Determine your eligibility

- Online validation/authentication of Aadhaar details

- Creation of a User ID and Password, which will be sent via SMS to the applicant’s registered mobile number – https://kviconline.gov.in/pmegpeportal/pmegphome/index.jsp

- Access the PMEGP portal to enter additional information.

- Upload the necessary documents

- Complete the Score Card and double-check the information.

- Submit Final Work

Applicant can track the status of application form submission until final disbursement and MM subsidy adjustment.

PMEGP Bank Nodal Officer List for PMEGP scheme?

For which businesses, loans are available under this PMEGP scheme?

You can get loan for starting a new business under PMEGP scheme. That is, if you want to start a new business then you can apply and get a loan.

If you have an existing business then you will not get loan under PMEGP scheme. For this, you can get loan under the second scheme of Central Government “PM MUDRA” Pradhan Mantri Mudra Yojana.

“PMEGP” In this scheme, loans are available for manufacturing business and services related business. If you do any manufacturing business, that is, you produce any item, such as the work of making any food item, such as the work of making papad, Ice Cream Manufacturing Business, food grains, torches, production industry, etc.

Similarly, for doing any business in the textile production sector like Hand loom Business, Khadi Activity, Zari Work etc. Similarly, for Plastic Manufacturing Business, one can get loan under PMEGP scheme for doing any similar plastic production business.

Also Check – Top 5 Important Government ID Card to have for Indians

PMEGP Portal Online Application Submission Video Tutorial for Individual Applicant Hindi and English

Click Here to Watch a Tutorial Video

Similarly, you can get loan for service related business, like if you do any dry cleaning work, Beauty Parlour, Cycle Motor, Cycle Repairing Business, Photocopy, Online Services etc., you can get loan under PMEGP scheme for this type of business.

Information about how many types of business lists are there and the list of all types of businesses that come under PMEGP scheme is also available on the official online site of pmegp. When you apply online, you can see the complete list from there.

Loans for businesses like meat, fish, beedi, cigarette, tobacco, liquor, VINE etc. are not available under PMEGP scheme. Before applying for loan, you must check its complete list from the official website.

So you must have understood that under PMEGP scheme, loan is available for starting a business and you can get loan for Manufacturing Business and Service Related Business. Let’s look further.

AGENCY WISE CONTACT NODAL DETAILS LIST IN INDIA

Click Here

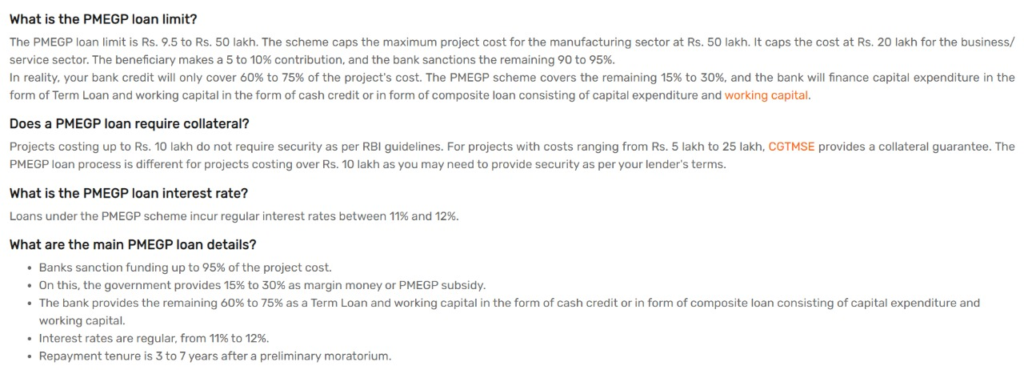

How much loan is available under PMEGP scheme?

If you want to do any service sector related business under PMEGP scheme, you can get a loan up to Rs 20 lakh. And if you want to take a loan to do manufacturing business, then you can get a loan up to Rs 50 lakh/-.

How much subsidy is available in PMEGP scheme and what is the interest rate?

To avail the benefits of PMEGP scheme, you have to contribute some amount yourself in your project and get a loan from some bank and also get the benefit of subsidy.

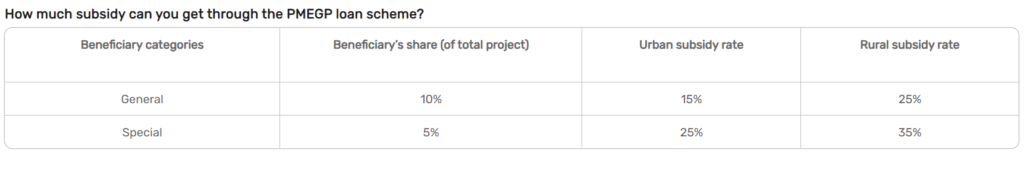

Let us understand this in detail, in General Category you have to make 10% Self Contribution and if you are from Urban Area then you will get 15% Subsidy and in Rural Area you will get 25% Subsidy.

How much subsidy for the PMEGP Loan Scheme?

Special Category :-

If you people of special category (SC, ST, OBC, HILL AND BORDER AREA) have to make 5% self contribution, 25% subsidy in urban area and 35% subsidy in rural area.

What is the estimated interest on loan under PMEGP Scheme?

Interest:- The estimated interest rate on taking loan under PMEGP scheme is around 10% to 15%, which also depends on the bank and your Cibile Score. If your Cibile Score is excellent then your interest rate can also be reduced and you can get the loan easily. Before taking a loan, you must check your Cibile Score. If any of your loans has defaulted then first of all you should improve your Cibile Score and after that if you apply for the loan then you will get the loan easily and the interest rate will also be less.

What are the necessary documents to take a PMEGP scheme loan?

To take PMEGP Loan, you should have the following important documents:-

- KYC Documents (Aadhar card, PAN Card, Voter Card, Passport, etc)

- EDUCATION CERTIFICATE (10th, 12th, Greducation, Diplomaa Certificate Etc.)

- EDP Certificate (Enterprenure Development Program Training Certificate)

- Project Report of Business

- ITR of 3 Years

- 6 Month, 2 Years Bank Balance sheet

- Land Registry / Lease Agreement

- Experience Certificate

- Life Insurance Certificate

- GST Registration Certificate (If there is GST then attach it as additional documents)

- Income Proof / Income Certificate

- Cast Certificate(ST,OBC)

- Resident Certificate and Passport size Photo, etc.

To apply for loan in PMEGP Scheme, you should have all the above documents so that you do not have to face any problem in taking the loan, apart from these, banks can also ask for some more documents as per their requirement.

How to get loan in PMEGP scheme or how to apply for this scheme?

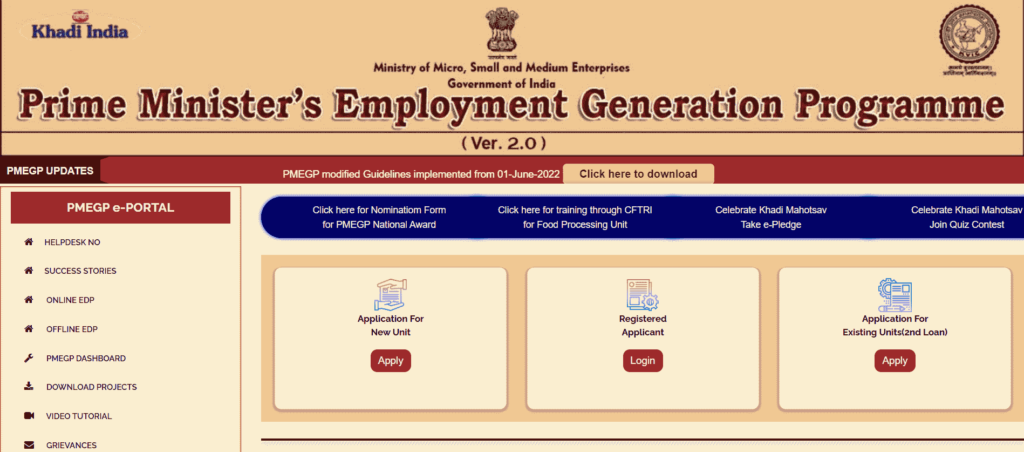

There is an online process to apply for PMEGP scheme, for this visit the official website of PMEGP www.kviconline.gov.in. After visiting this site, a page like this will open in front of you.

After this, go to the option of Application for new unit and fill the application form online. A video is given above on how to fill the online form. You can apply the online form by watching this video. After online completion, you have to download the final receipt, attach all the documents mentioned above with the receipt and visit the bank and complete the application process by verifying the loan details and online information from the bank officer. For more information about the application, before taking the loan, visit the bank and get information about it.

Frequently Asked Questions on PMEGP Scheme Loan(FAQ)

In this way you can get loan for business under PMEGP scheme. I hope this will be important information for you. If you have any question then please write in comment. govt scheme related information.

Pingback: WANTED: Drivers to Operate Electric Buses in Goa for SV Trans Pvt. Ltd - Goa Nirvana

Pingback: Apply Online for Agniveervayu Intake 2024 Batch Indian Airforce job Notification 2024 - Goa Nirvana